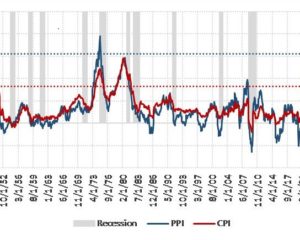

Uncertainties around inflation, Fed tightening, and the resilience of the U.S. economy grew more worrisome in the second quarter, sparking a broad-based selloff in stocks and bonds. Coupled with the declines of the first quarter, all major indices have spilled over into bear market territory. Markets had hoped to see signs that inflationary pressures, albeit high, were beginning to roll over by mid-year. No such luck as the May Consumer Price Index sparked a new round of selling pressure and caused the Fed to ratchet up their hawkish rhetoric, most likely coming at the expense of the economy.

Current economic conditions of a tight labor market, relatively healthy consumer, and strong corporate balance sheets are atypical of a pending economic downturn. Other measures like declining new home construction and manufacturing data, a pickup in layoffs, and a pullback in commodity prices are pointing in the other direction. In this update, we highlight below some of the important issues that are affecting markets and the assessment of recession risk, as well as what could leave us with a better outcome than the hard landing that is now feared.

Key Investment Issues

- Inflation: The focus has moved from identifying when inflation peaks to the pace of its decline and what a terminal inflation rate will be. The markets believe that if the Fed sticks to their current rate hike plans (another 175-

200 basis points before year-end), recession will follow. If the on-going rate stays materially above their long-term 2% target, the Fed will likely stay in active tightening mode.

200 basis points before year-end), recession will follow. If the on-going rate stays materially above their long-term 2% target, the Fed will likely stay in active tightening mode.

- Supply Chain Constraints: The Fed has openly acknowledged that the tool of higher interest rates will not have a direct effect on many of the key supply side components that are driving inflation (food, gasoline, and rent). Being limited to impacting the demand side makes the goal of achieving a soft landing more challenging. Labor shortages and China’s Zero COVID policy continue to plague this issue.

Consumer: The case for recession weakens greatly if consumer spending holds up. Recent earnings reports from retail bellwethers Walmart and Target raised concerns that inflation was beginning to impact consumer behavior. At the same time, the demand for service related activities (travel, dining, entertainment) have been strong. Personal savings rates have come down and credit card expenditures are up. The U.S. consumer has often proved more resilient than given credit for.

Consumer: The case for recession weakens greatly if consumer spending holds up. Recent earnings reports from retail bellwethers Walmart and Target raised concerns that inflation was beginning to impact consumer behavior. At the same time, the demand for service related activities (travel, dining, entertainment) have been strong. Personal savings rates have come down and credit card expenditures are up. The U.S. consumer has often proved more resilient than given credit for.

- Fed Credibility: The Fed has been blamed for missing the opportunity to tighten when the economy was stronger and for sticking too long with their transitory view of inflation. Their crusade to restore their credibility raises the risk that they will now err on the side of tightening too much.

- Ukraine: This is turning into a war of attrition. Russia has managed to maintain its stream of revenues from oil while keeping oil prices elevated and restoring the value of their currency. While oil and grain supplies will likely stay tight for the foreseeable future, their impact on inflation will diminish unless prices continue to ascend from current levels.

- Wealth Effect: The Fed’s efforts to slow the economy down is getting help from sources other than higher interest rates. The year-to-date loss in stock market valuation ($8.5 trillion) has a negative wealth effect on consumers and may lead to reduced spending. The gradual shrinking of the Fed’s balance sheet (quantitative tightening) will also serve to temper economic growth. The hope is that the combined effect of these mitigating factors will keep the Fed from having to raise interest rates as high as would otherwise be needed.

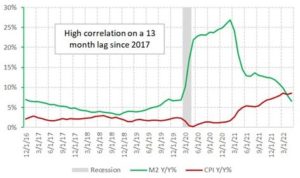

Monetarist View: This economic perspective believes that the supply of money in the financial system is the primary driver of economic growth. As such, the unprecedented expansion of money in the pandemic to prevent an economic depression is seen as the underlying cause of the spike in inflation today. The money supply has crested (green line) and is in decline. With a 13-month lag, monetarists believe inflation (red line) will now follow suit, allowing the Fed to take their foot off the brake before triggering a recession.

Monetarist View: This economic perspective believes that the supply of money in the financial system is the primary driver of economic growth. As such, the unprecedented expansion of money in the pandemic to prevent an economic depression is seen as the underlying cause of the spike in inflation today. The money supply has crested (green line) and is in decline. With a 13-month lag, monetarists believe inflation (red line) will now follow suit, allowing the Fed to take their foot off the brake before triggering a recession.

- China: The Zero COVID policies have depressed growth in China and exacerbated supply chain challenges. The reopening of major cities will reengage their manufacturing process and should take pressure off supply shortages.

- Oil: Prices have pulled back from their recent peak as tight supplies are being partially offset by concerns of a global slowdown. The broad commodity index (CRB) has already pulled back significantly from recent highs. Copper, a bellwether for industrial metals, was off almost 20% in the second quarter, suggesting the economy is already in slowdown mode.

- Corporate Earnings: Upcoming second quarter reports will provide insight on input cost pressures and signs of reduced demand. There are concerns that consensus earnings estimates are still too high. Stocks appear to be frontrunning likely estimate cuts from analysts. The strong dollar will also have a negative impact on reported earnings of U.S. companies with global markets.

- Crypto: While not in our direct investment universe, the collapse of digital currencies warrants commentary from two perspectives. Crypto was touted as a hedge against inflation and a diversifier for investment purposes. Instead, it has performed like a highly leveraged version of any other risky asset in a bear market. The 70% decline in the market cap of digital assets has disproportionately stung retail investors. Second, there was the potential of systemic risk that the failure of “stable coin” currencies to maintain their value and the dysfunctional performance of the crypto loan business (DeFi) would spill over to traditional investments, but the markets have absorbed this debacle reasonably well. Crypto enthusiasts remain steadfast in their convictions.

Outlook

Consensus thought about the economy is moving toward a recession of moderate depth and a prolonged duration. The sticky components of inflation will make it difficult for the Fed to curtail their tightening before undermining the economy. The case for a moderate recession is supported by a healthier consumer, a more financially sound banking structure, and a housing market with strong supply/demand fundamentals. Employers are less likely to institute huge layoffs under today’s tight labor conditions, exacerbated by baby boomer retirements. Leverage in the financial system is also not the speculative levels previously seen.

Consensus thought about the economy is moving toward a recession of moderate depth and a prolonged duration. The sticky components of inflation will make it difficult for the Fed to curtail their tightening before undermining the economy. The case for a moderate recession is supported by a healthier consumer, a more financially sound banking structure, and a housing market with strong supply/demand fundamentals. Employers are less likely to institute huge layoffs under today’s tight labor conditions, exacerbated by baby boomer retirements. Leverage in the financial system is also not the speculative levels previously seen.

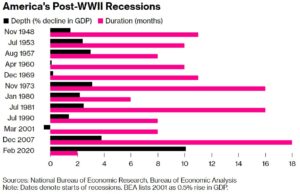

The average length of recessions since WWII is 10 months, accompanied by a 2.5% GDP contraction, 3.8% higher unemployment, and a 15% hit to corporate earnings. We may learn that the economy is already in recession (if narrowly defined by two consecutive quarters of GDP contraction), or it may hold off well into 2023. The relevance of this is more backwards looking as markets will typically price in the effects of a recession well before we know we are in one.

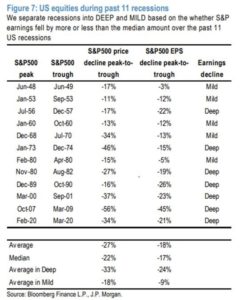

Only three of the last 14 bear markets have escaped recession. The average decline in stocks shows 27% with a wide range. We take none of this for granted as we look to the back half of the year and beyond. We do observe that markets tend to move more quickly in both directions these days and there are numerous indicators, including investor sentiment, the decline in housing stocks, and collapse of some commodity prices that have already reached the levels of previous recessions.

Only three of the last 14 bear markets have escaped recession. The average decline in stocks shows 27% with a wide range. We take none of this for granted as we look to the back half of the year and beyond. We do observe that markets tend to move more quickly in both directions these days and there are numerous indicators, including investor sentiment, the decline in housing stocks, and collapse of some commodity prices that have already reached the levels of previous recessions.

While we wait for more clarity on the Fed, inflation, and the economy, we will focus on owning a mix of companies in our respective strategies that meet our quantitative and qualitative criteria. Some we expect to hold up better in the current environment, and others that will lead the recovery when there is more certainty on when the Fed tightening is complete, paving the way for a new cycle of economic growth.

Portfolio Positioning

- Asset Mix: Cash balances are up slightly. Equity exposure has pulled back modestly in balanced portfolios from declining stock prices. We intend to maintain equity exposure close to policy target to participate fully when markets recover. Rising bond yields now provide a more attractive base level of interest for funds dedicated to safety.

- Valuation: Extreme valuations have been addressed. Broad market valuations have declined meaningfully. Potential earnings risk from a recession would likely pressure valuations further.

- Economy: Our macro work confirms the economy is moving through the business cycle more quickly than previous cycles and now advancing to the late cycle stage. Risk of recession is high, severity a function of inflation’s persistence.

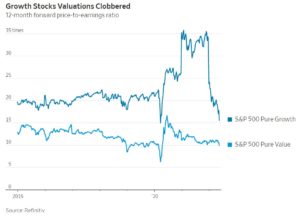

Equity Styles: The valuation differential between Value and Growth strategies are now closer to normal, although growth stocks are not cheap. An economic downturn would impact the defensive and cyclical components of both styles. Secular growth could return to favor in an extended economic downturn, while value/cyclical stocks would likely be positioned well to lead a new economic cycle.

Equity Styles: The valuation differential between Value and Growth strategies are now closer to normal, although growth stocks are not cheap. An economic downturn would impact the defensive and cyclical components of both styles. Secular growth could return to favor in an extended economic downturn, while value/cyclical stocks would likely be positioned well to lead a new economic cycle.

- Stocks: Our approach balances the risks of this environment with the opportunities that are created when signs of panic and fear become visible. Our quantitative work favors high quality companies with strong free cash flow margins. Stock selection will tend toward larger companies with markets in turmoil, leaning more toward defensive versus cyclical exposures. The grounding we have in our decision-making process is helpful in seeing through the noise that accompanies extreme volatility.

- Bonds: The sharp move higher in short and intermediate-term bond yields raises the prospective yield-to-maturity of our bond portfolios without having to extend duration. Higher bond yields will provide some offset to pricing weakness if rates continue to move higher from current levels. Municipal bonds are buyable again for taxable portfolios. Corporate bond spreads should continue to widen as the economy softens, prompting us to stay high quality.