Worries about inflation, rising interest rates, and a contracting economy became more acute as the third quarter came to a dispirited end. Rising bond yields stoked by the Fed’s recommitment to bring down inflation weighed heavily on stock and bond prices. Heightened aggression in Ukraine from Vladimir Putin added to the noise at quarter-end, as did emergency intervention from the Bank of England to calm their bond market, and recent earnings announcements from several blue-chip companies that warned of more difficult times ahead.

All major indices ended the quarter in bear-market territory, marking three consecutive quarters of decline for the first time since 2008. A promising summer rally provided some respite on hopes that inflation had peaked and rate hikes would pause. Those hopes were soon dashed when inflationary pressures resumed and the Fed rhetorically threw in the towel on a soft economic landing in their quest to restore price stability. This year’s bear market rallies have lived up to their cruel reputation.

In the commentary below, we summarize briefly, (1) how we got here and whether this was inevitable, (2) what does history tell us about where we go from here, and (3) what bearing does this have on our investment strategies with Portfolio Manager commentary.

The Paradigm Shifts, But Not As Expected

The transition of highly accommodative financial conditions since the Great Financial Crisis (2008-2009) was inevitable. This model of ultra-low interest rates and excess liquidity was not sustainable, but prior to the pandemic, it was unclear how the investment-friendly cycle of slow, steady economic growth, benign inflation, and healthy employment would end of natural causes. The pandemic assured us that we will never know.

Instead, the policy response to protect the economy from risks of unknown scale took these accommodative financial conditions to an extreme. Markets persevered. The Fed’s plan to gradually transition this year to more normal financial conditions was upended by a combination of incorrect assumptions, poor judgements, and unpredictable consequences. As a result, the transition has been more abrupt and severe. Markets have reacted to increasingly restrictive pressure from the Fed, all increasing the likelihood of a recession of some significance.

Primary among Fed policy errors were: (1) pumping liquidity into the financial system long after the need had passed, (2) believing that the initial spike in inflation was transitory and soon to pass, and (3) adopting what’s called a “symmetrical” view on inflation (focusing on the average inflation rate instead of the most recent data) at precisely the wrong time.

The Fed is an easy target, but not all of the obstacles were of their making. In particular, (1) Russia’s invasion of Ukraine and the impact on energy and other commodity prices, (2) U.S. and global energy policies caught flatfooted in the rush to transition to renewables, (3) China’s zero COVID policies extending supply chain imbalances, (4) the unanticipated post-pandemic attrition of the U.S. workforce, and (5) massive increases in the money supply from U.S. Treasury and Congressional spending.

For investors who have suffered the declines in stock and bond prices this year, it is of little consequence to hypothesize what might have resulted from a different set of decisions and circumstances. History shows that transitions from extreme levels are rarely smooth. That said, outcomes are not always as inevitable as they appear in hindsight.

Is History Helpful In Framing Expectations Or Is It Different This Time?

There are numerous examples in history of the Fed tightening financial conditions to rein in inflation. Clearly the circumstances of the pandemic have made this cycle different, but the combination of supply and demand-driven imbalances provide points of comparison to past inflationary cycles. All tightening cycles involve the risk of doing too much, causing the economy to tip over. It is a difficult strategy to implement because of the considerable time lag between an interest rate hike and detecting its impact on the economy.

Not surprising, few of these tightening cycles get it right. Today’s three consecutive 75 basis point rate hikes (with more to come) will run the risk of overtightening because of how quickly these hikes have occurred. The last time an actual soft landing was achieved was 1994. Fed Chair Greenspan raised interest rates by 3% in 12-months without undermining the economy. However, inflation was much lower when that process began, and in contrast to today, expanding globalization trends were a strong counterbalance.

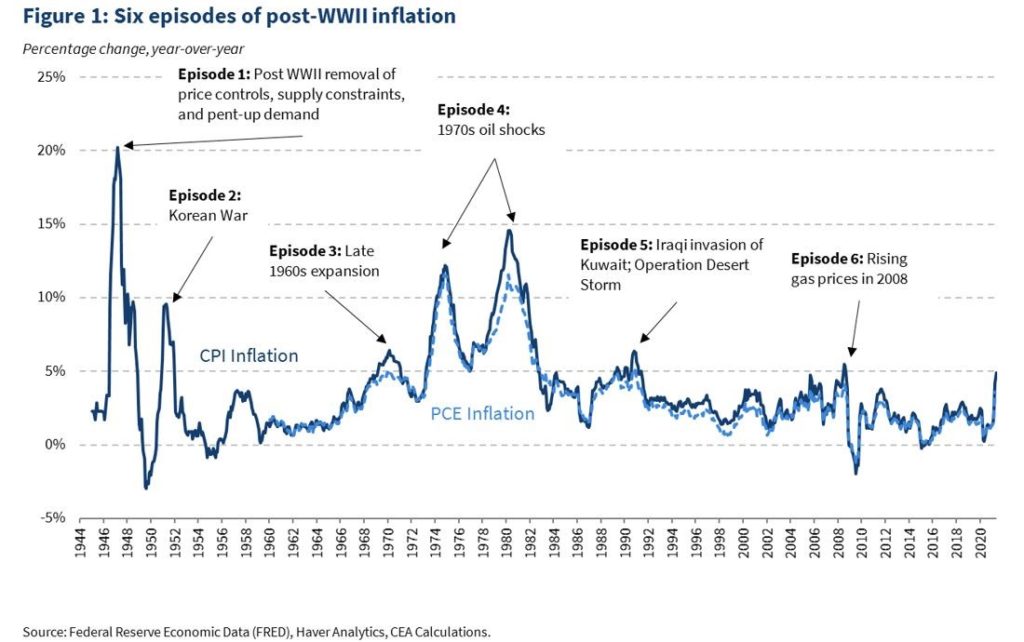

There have been a total of six episodes where inflation spikes have exceeded 5% since WWII.

The three most recent spikes were driven by oil shocks, the most memorable in the early 80’s, chasing CPI to almost 15%. Paul Volker fixed the problem by crushing the economy. There are worries that today’s inflation is on that track. In spite of some similarities, inflation is not likely to push to those levels. While the crisis in Ukraine has disrupted the energy markets, high oil prices are just one component of today’s inflationary pressures. There are also differences in demographics, labor market structure, and the fact that the U.S. is now a net exporter of oil.

The most comparable situation to present day is the post-WWII spike in inflation. This was caused by both supply constraints (goods had been shifted to military production) and pent up demand from consumers that followed the end of the war. While we are not in a wartime scenario, the pandemic shifted manufacturing priorities and created excess demand from consumers when the economy reopened. After WWII, inflation fell rapidly once supply chains and demand were normalized. There are current signs that supply issues are improving and the sharp increase in interest rates has already softened demand for housing and other durable goods. This past scenario suggests that inflation could also decline rapidly if we see similar progress on supply and demand trends, as well as a sharp decline in the money supply, which is well in progress.

Risk of recession remains high as the Fed does not want to repeat the mistakes of the ‘70s. In that cycle, tightening policy eased up after inflation data improved, only to see inflation subsequently roar back. If the Fed sticks to their 2% inflation goal, interest rates will stay higher for a longer period of time. The recent weakness in stocks has begun to incorporate this potential negative impact on the economy and corporate earnings.

If the Fed sees more progress on subduing both inflation and growth heading into next year, they might stray from their current script. That is a near-term upside for stocks, since the markets are currently placing less faith in this outcome

How Do These Macro Developments Impact Our Investment Strategies?

As bottom-up investors focusing first on finding individual companies with attractive growth and valuation characteristics, we also pay close attention to the broad investment environment. This is especially the case when the business cycle is at an inflection point. Our Macro Strategist and Fixed Income Manager, John Wallis, maintains a robust macroeconomic analysis process that guides our big picture views. These tools help shape our overall risk positioning, as well as inform sector exposure and security specific risks. We also know that when markets are in turmoil, a quantitative investment process helps keep our focus and look past the short-term emotion of markets.

Our security selection has always favored higher quality stocks with strong free cash flow characteristics. Quality stocks are usually higher market capitalization and have a record of dependable earnings. In this highly uncertain environment, quality would typically hold up better. That has not been the case this year on the growth stock side. Investors’ preference for quality has historically put a valuation premium on these companies. In a year with rising bond yields and pressure on stock multiples, quality stocks, in general, have underperformed. We believe that when interest rates approach their peak, quality stocks will again earn back their valuation premium.

Below are strategy-specific comments from the Portfolio Managers of our three core equity strategies. Broadly speaking, our security selection process focuses on stocks with above average cash flow return on investment (CFROI), cash flow yield, and specific value, growth, and momentum factors that have demonstrated the greatest return spreads between the top and bottom decile rankings of our stock universe.

Value Equity – Sharon Divine, CFA

Value strategies held up better earlier in the year as concerns were primarily focused on inflation and higher interest rates. As these concerns broadened to recessions fears, equity style became less of a factor. The Value Equity strategy remains well diversified among the 11 economic sectors, ranging from defensive to cyclical. Valuation, free cash flow generation, and capital deployment continue to be central to our quantitative analysis. The strategy remains overweight in Healthcare, which tends to be more defensive. Our work shows that research and development investment among pharmaceutical and biotech companies is priced low relative to history and to R&D investment in other sectors. As such, we continue to look for opportunities in this area. Among the traditionally more defensive groups, Healthcare is priced at more reasonable valuations while generating higher cash flow returns on investment. Utilities and Consumer Staples remain relatively expensive.

Growth Equity – Len Mitchell, CFA

The outlook for Growth stocks remains mixed. While the valuation spread has been largely addressed, growth stocks will remain sensitive to rising interest rates and investor sentiment. We expect to remain underweight consumer discretionary stocks as the outlook for rising unemployment, negative real wage gains, and higher shelter costs weigh on consumer confidence. Health care will remain a relatively safe haven, warranting a full sector weight. In Technology (40% of the portfolio exposure) we will continue our qualitative focus on companies with defensive moats and technologies essential to the 21st century economy. We will look for an opportunity to add to our semiconductor exposure, focusing on equipment stocks that benefit from the trend toward smaller geometries. Longer term, we expect industries participating in the accelerating shift away from carbon-based energy toward sustainable, locally sourced energy, and companies that equip biotechnology research and production to be attractive candidates for consideration.

Yield-Focus Equity – Clint Anderson, CFA

Dividend strategies have performed relatively well this year with good exposure to two of the better performing sectors, Energy and Utilities. More recently, rising bond yields may provide an alternative for more conservative investors seeking income. The recent weakness in Utilities, Staples and REITs was likely impacted by this relationship. Still, these sectors will continue to be attractive holdings for our strategy because of the stability of earnings, the size, strength, and safety of dividends, and the current slowing global economy. Non-U.S. investments may begin to represent good long-term value opportunities given the relative underperformance from this group over many years and above average dividends.

Last Thoughts

In difficult environments like this, we depend on the work we’ve done to establish the appropriate mix between risk and safety in each of our clients’ portfolios. We know it is never easy to see asset balances decline, but hopefully, the asset mix allows each of us to ride through the cycle intact. When stocks have experienced significant declines in advance of a recession, history says to stay invested. We appreciate that the magnitude of “significant” and the time frame of “advance” are unknowable, but the general message is the same – this is the best way we can emerge from the cycle.

It is also helpful in these times to think about the actual investments that are held in a portfolio. For equity investors, it is a share of a company’s future earnings. For bondholders, it is the security that the borrower will return your capital along with the interest that was promised. Clearly, all the big picture changes in the business cycle, currencies, and interest rates will have an impact on earnings and bond yields, but the overriding bet is on a capitalistic system that enables the best businesses in the world to continue selling their goods and services to consumers and businesses in need. The long-term opportunity to prosper from investing in these companies is unchanged.